See This Report about Custom Private Equity Asset Managers

You have actually possibly listened to of the term private equity (PE): buying business that are not openly traded. Roughly $11. 7 trillion in assets were managed by exclusive markets in 2022. PE companies look for opportunities to make returns that are far better useful content than what can be achieved in public equity markets. However there might be a couple of points you do not recognize about the market.

Private equity companies have a range of investment choices.

Because the very best gravitate toward the larger bargains, the center market is a substantially underserved market. There are a lot more vendors than there are highly skilled and well-positioned financing specialists with extensive buyer networks and sources to handle a bargain. The returns of private equity are normally seen after a couple of years.

Custom Private Equity Asset Managers Can Be Fun For Everyone

Traveling listed below the radar of large multinational companies, most of these tiny business often provide higher-quality customer care and/or particular niche services and products that are not being used by the large empires (http://dugoutmugs01.unblog.fr/?p=3148). Such benefits attract the interest of private equity firms, as they possess the insights and savvy to exploit such chances and take the firm to the following level

Many supervisors at profile companies are provided equity and benefit compensation structures that reward them for striking their financial targets. Exclusive equity chances are commonly out of reach for people who can't spend millions of dollars, but they should not be.

There are guidelines, such as limitations on the accumulation quantity of cash and on the number of non-accredited capitalists (Private Investment Opportunities).

The Main Principles Of Custom Private Equity Asset Managers

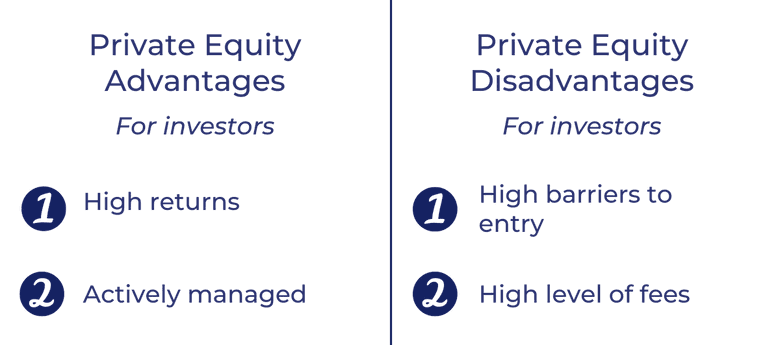

One more disadvantage is the lack of liquidity; when in a personal equity transaction, it is not easy to get out of or offer. There is a lack of adaptability. Personal equity also features high fees. With funds under monitoring already in the trillions, private equity companies have come to be attractive financial investment cars for wealthy people and institutions.

Now that access to private equity is opening up to even more specific financiers, the untapped potential is ending up being a truth. We'll begin with the primary debates for investing in personal equity: Exactly how and why personal equity returns have actually historically been greater than other assets on a number of levels, How including private equity in a portfolio influences the risk-return account, by helping to diversify versus market and cyclical risk, Then, we will certainly lay out some vital factors to consider and threats for personal equity financiers.

When it concerns introducing a new property right into a profile, the a lot of basic factor to consider is the risk-return account of that property. Historically, personal equity has actually displayed returns comparable to that of Arising Market Equities and greater than all various other conventional asset classes. Its reasonably reduced volatility combined with its high returns makes for an engaging risk-return profile.

Custom Private Equity Asset Managers Can Be Fun For Everyone

In reality, exclusive equity fund quartiles have the best variety of returns across all different asset courses - as you can see below. Method: Internal price of return (IRR) spreads out determined for funds within vintage years individually and afterwards balanced out. Average IRR was calculated bytaking the average of the typical IRR for funds within each vintage year.

The takeaway is that fund option is crucial. At Moonfare, we perform a stringent option and due diligence procedure for all funds listed on the system. The impact of adding private equity right into a portfolio is - as always - depending on the profile itself. A Pantheon research study from 2015 suggested that consisting of private equity in a profile of pure public equity can unlock 3.

On the other hand, the very best personal equity companies have accessibility to an also larger swimming pool of unidentified opportunities that do not face the exact same examination, in addition to the sources to execute due persistance on them and recognize which deserve purchasing (Private Equity Platform Investment). Spending at the first stage suggests greater threat, however, for the business that do be successful, the fund gain from higher returns

Our Custom Private Equity Asset Managers Statements

Both public and private equity fund managers dedicate to spending a percent of the fund yet there continues to be a well-trodden issue with aligning interests for public equity fund administration: the 'principal-agent issue'. When a financier (the 'primary') employs a public fund supervisor to take control of their funding (as an 'representative') they hand over control to the supervisor while maintaining possession of the possessions.

In the instance of exclusive equity, the General Companion doesn't simply earn an administration cost. They also earn a percentage of the fund's profits in the form of "carry" (usually 20%). This ensures that the interests of the supervisor are aligned with those of the capitalists. Exclusive equity funds likewise reduce one more form of principal-agent trouble.

A public equity capitalist inevitably wants something - for the management to raise the stock price and/or pay returns. The investor has little to no control over the choice. We showed above the amount of private equity approaches - particularly majority acquistions - take control of the running of the firm, guaranteeing that the long-term worth of the company comes initially, raising the roi over the life of the fund.